ERC-3643 Standard

T-Rex Protocol

Industry-leading security token standard with built-in transfer restrictions, identity management, and regulatory compliance. Ensure your tokens meet international securities regulations.

Benefits

Specifications

How-to

Contact Us

Learn More

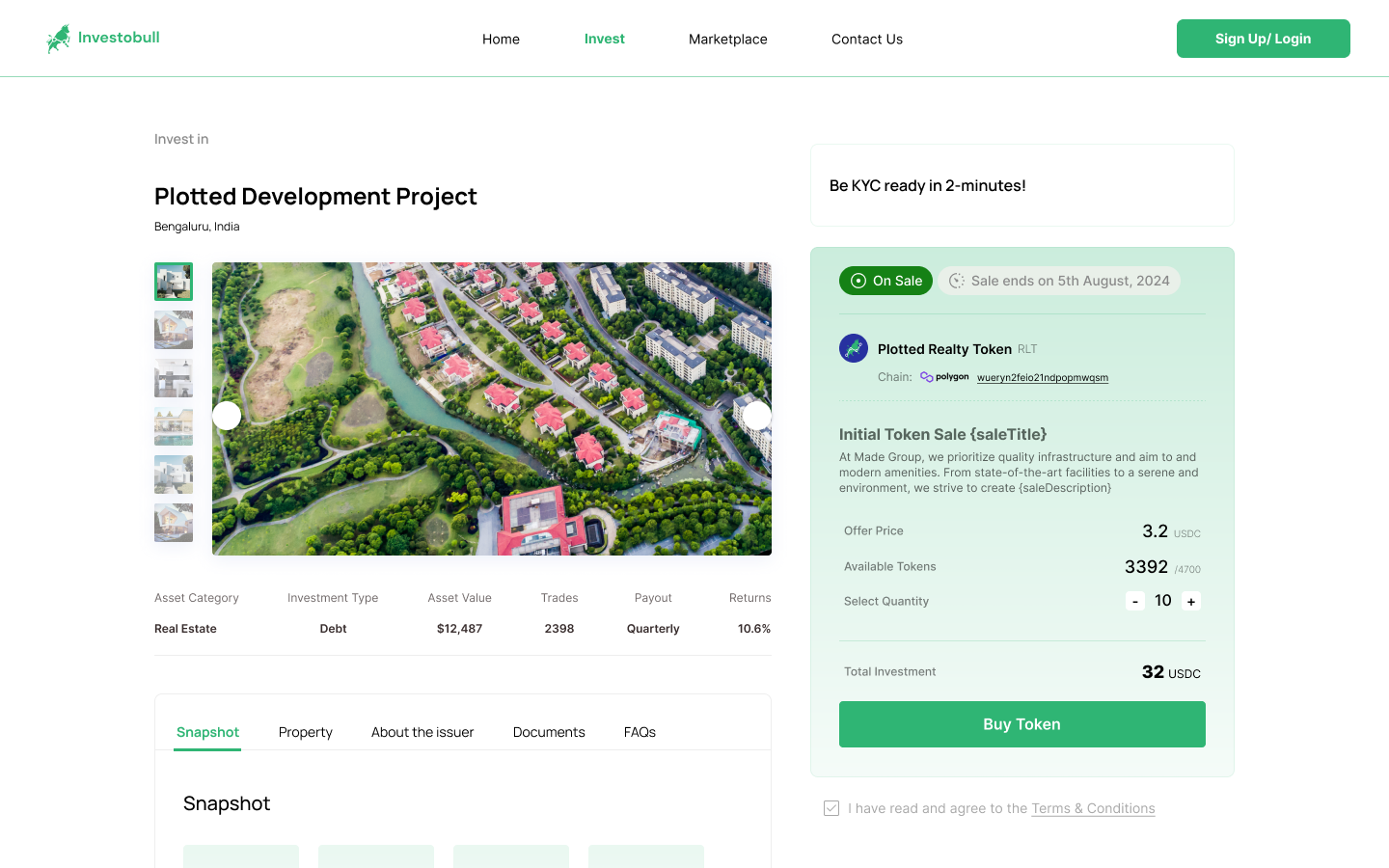

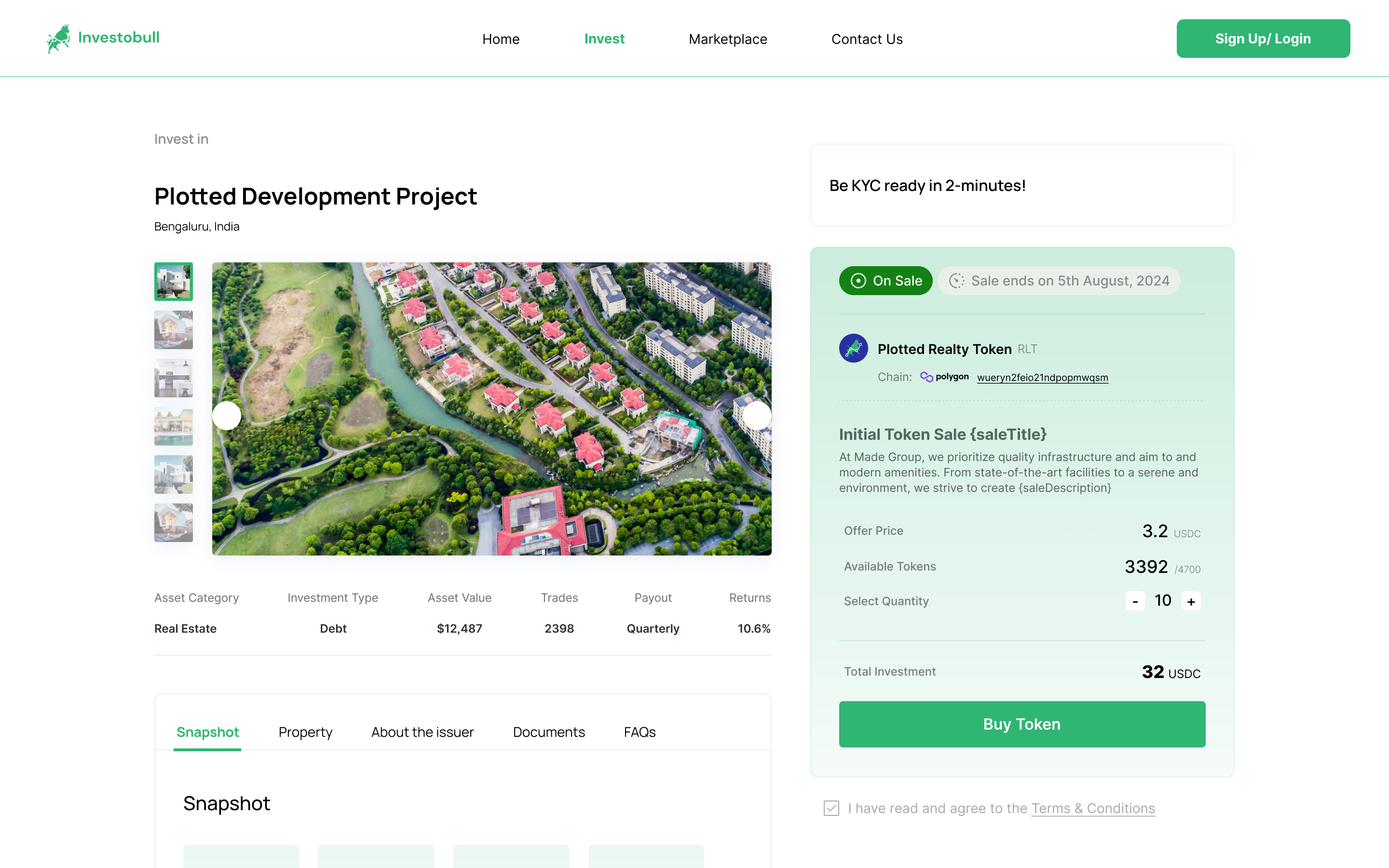

The Shopify for Tokenized Assets

Build Your Token Marketplace in

Minutes

OpenRWA empowers asset owners and issuers to create, launch, and manage their own tokenized asset marketplaces—no blockchain expertise required.

500+

Assets Tokenized

$2B+

Trading Volume

50+

Live Marketplaces

Limited Time Offer

Launch Your Marketplace for FREE

Get 3 months of free end-to-end asset publishing and tokenization.

Pay only for transactions. No setup fees, no monthly charges.

Claim Free Offer

Everything You Need to Launch Your Marketplace

Focus on growing your business while we provide the infrastructure, security, and compliance

Why OpenRWA

Launch in Days, Not Months

Pre-built infrastructure means your token marketplace goes live faster than custom development

Enterprise-Grade Security

Built on battle-tested blockchain technology with compliance and regulatory frameworks

No Blockchain Expertise Needed

Focus on your assets and customers—we handle the complex blockchain infrastructure

Global Trading 24/7

Enable worldwide access to your assets with frictionless cross-border transactions

Customizable & White-Label

Fully branded experience that matches your business identity and requirements

End-to-End Platform

Everything from tokenization to trading, custody, and settlement in one platform

Everything You Need to Launch Your Marketplace

Why OpenRWA

Why OpenRWA

Everything You Need to Launch Your Marketplace

From concept to live marketplace—faster than you ever imagined

Why OpenRWA

01

Define Your Assets

Choose what you want to tokenize—real estate, art, commodities, or any valuable asset

02

Configure Your Marketplace

Customize your platform with your branding, rules, and compliance requirements

03

Launch & Scale

Go live with your token marketplace and start connecting with investors globally

Everything You Need to Launch Your Marketplace

Launch your marketplace on leading blockchain networks with full EVM compatibility

Why OpenRWA

Ethereum

The world's leading smart contract platform

Polygon

Scalable and low-cost transactions

Avalanche

Lightning-fast finality and throughput

BNB Chain

High performance and efficiency

Full EVM Compatibility

Seamlessly deploy across all Ethereum Virtual Machine compatible chains. One codebase, unlimited possibilities.

Everything You Need to Launch Your Marketplace

Meet regulatory requirements with confidence. OpenRWA includes enterprise-grade compliance tools

Why OpenRWA

T-Rex Protocol

Industry-leading security token standard with built-in transfer restrictions, identity management, and regulatory compliance. Ensure your tokens meet international securities regulations.

Identity Verification

Integrated Know Your Customer and Anti-Money Laundering checks powered by leading identity verification providers. Onboard users confidently and stay compliant.

Legally Binding

Collect legally binding electronic signatures for subscription agreements, disclosures, and regulatory documents. Blockchain-verified audit trail included.

Investor Verification

Verify accredited investor status automatically through income, net worth, and professional credential checks. Maintain detailed compliance records effortlessly.

OpenRWA handles End-to-End Regulatory Compliance so you can focus on growing your business.

Everything You Need to Launch Your Marketplace

From crypto wallets to traditional fiat payments—support global transactions with ease

Why OpenRWA

Custodial Wallet

Managed security for your users

Enterprise-grade custodial wallet infrastructure that handles key management, security, and compliance—so your users don't have to worry about private keys.

Bank-grade security and encryption

Automated backup and recovery

Seamless onboarding experience

Non-Custodial Wallets

Self-custody for power users

Connect with popular Web3 wallets for users who prefer to maintain control of their assets. Full compatibility with leading wallet providers.

MetaMask

Trust Wallet

Coinbase

Fiat Payments

Accept credit cards, bank transfers, and local payment methods worldwide

Multi-Lingual

Reach global audiences with support for 50+ languages out of the box

Multi-Currency

Display prices and accept payments in 150+ fiat and cryptocurrencies

Payout & Buyback

Automated dividend distributions and token buyback programs for liquidity

Ready to Build Your Token Marketplace?

Join hundreds of asset owners who are already tokenizing their assets and creating new markets

List Asset for Free

Book a Demo

The Shopify for Tokenized Assets

Build Your Token Marketplace in

Minutes

OpenRWA empowers asset owners and issuers to create, launch, and manage their own tokenized asset marketplaces—no blockchain expertise required.

500+

Assets Tokenized

$2B+

Trading Volume

50+

Live Marketplaces

Limited Time Offer

Launch Your Marketplace for FREE

Get 3 months of free end-to-end asset publishing and tokenization.

Pay only for transactions. No setup fees, no monthly charges.

Claim Free Offer

Why OpenRWA

Everything You Need to Launch Your Marketplace

Focus on growing your business while we provide the infrastructure, security, and compliance

Launch in Days, Not Months

Pre-built infrastructure means your token marketplace goes live faster than custom development

Enterprise-Grade Security

Built on battle-tested blockchain technology with compliance and regulatory frameworks

No Blockchain Expertise Needed

Focus on your assets and customers—we handle the complex blockchain infrastructure

Global Trading 24/7

Enable worldwide access to your assets with frictionless cross-border transactions

Customizable & White-Label

Fully branded experience that matches your business identity and requirements

End-to-End Platform

Everything from tokenization to trading, custody, and settlement in one platform

Why OpenRWA

Everything You Need to Launch Your Marketplace

Why OpenRWA

Everything You Need to Launch Your Marketplace

From concept to live marketplace—faster than you ever imagined

01

Define Your Assets

Choose what you want to tokenize—real estate, art, commodities, or any valuable asset

02

Configure Your Marketplace

Customize your platform with your branding, rules, and compliance requirements

03

Launch & Scale

Go live with your token marketplace and start connecting with investors globally

Why OpenRWA

Everything You Need to Launch Your Marketplace

Launch your marketplace on leading blockchain networks with full EVM compatibility

Ethereum

The world's leading smart contract platform

Polygon

Scalable and low-cost transactions

Avalanche

Lightning-fast finality and throughput

BNB Chain

High performance and efficiency

Full EVM Compatibility

Seamlessly deploy across all Ethereum Virtual Machine compatible chains. One codebase, unlimited possibilities.

Why OpenRWA

Everything You Need to Launch Your Marketplace

Meet regulatory requirements with confidence. OpenRWA includes enterprise-grade compliance tools

T-Rex Protocol

Industry-leading security token standard with built-in transfer restrictions, identity management, and regulatory compliance. Ensure your tokens meet international securities regulations.

Identity Verification

Integrated Know Your Customer and Anti-Money Laundering checks powered by leading identity verification providers. Onboard users confidently and stay compliant.

Legally Binding

Collect legally binding electronic signatures for subscription agreements, disclosures, and regulatory documents. Blockchain-verified audit trail included.

Investor Verification

Verify accredited investor status automatically through income, net worth, and professional credential checks. Maintain detailed compliance records effortlessly.

OpenRWA handles End-to-End Regulatory Compliance so you can focus on growing your business.

Why OpenRWA

Everything You Need to Launch Your Marketplace

From crypto wallets to traditional fiat payments—support global transactions with ease

Custodial Wallet

Managed security for your users

Enterprise-grade custodial wallet infrastructure that handles key management, security, and compliance—so your users don't have to worry about private keys.

Bank-grade security and encryption

Automated backup and recovery

Seamless onboarding experience

Non-Custodial Wallets

Self-custody for power users

Connect with popular Web3 wallets for users who prefer to maintain control of their assets. Full compatibility with leading wallet providers.

MetaMask

Trust Wallet

Coinbase

Fiat Payments

Accept credit cards, bank transfers, and local payment methods worldwide

Multi-Lingual

Reach global audiences with support for 50+ languages out of the box

Multi-Currency

Display prices and accept payments in 150+ fiat and cryptocurrencies

Payout & Buyback

Automated dividend distributions and token buyback programs for liquidity

Ready to Build Your Token Marketplace?

Join hundreds of asset owners who are already tokenizing their assets and creating new markets

Start Building Free

Book a Demo

The Shopify for Tokenized Assets

Build Your Token Marketplace in

Minutes

OpenRWA empowers asset owners and issuers to create, launch, and manage their own tokenized asset marketplaces—no blockchain expertise required.

Start Building Free

Book a Demo

500+

Assets Tokenized

$2B+

Trading Volume

50+

Live Marketplaces

Limited Time Offer

Launch Your Marketplace for FREE

Get 3 months of free end-to-end asset publishing and tokenization.

Pay only for transactions. No setup fees, no monthly charges.

Claim Free Offer

Why OpenRWA

Everything You Need to Launch Your Marketplace

Focus on growing your business while we provide the infrastructure, security, and compliance

Launch in Days, Not Months

Pre-built infrastructure means your token marketplace goes live faster than custom development

Enterprise-Grade Security

Built on battle-tested blockchain technology with compliance and regulatory frameworks

No Blockchain Expertise Needed

Focus on your assets and customers—we handle the complex blockchain infrastructure

Global Trading 24/7

Enable worldwide access to your assets with frictionless cross-border transactions

Customizable & White-Label

Fully branded experience that matches your business identity and requirements

End-to-End Platform

Everything from tokenization to trading, custody, and settlement in one platform

Tokenize Any Asset

Turn Any Valuable Asset Into a Trading Marketplace

Simple Process

Launch your Marketplace in 3 Steps

From concept to live marketplace—faster than you ever imagined

01

Define Your Assets

Choose what you want to tokenize—real estate, art, commodities, or any valuable asset

02

Configure Your Marketplace

Customize your platform with your branding, rules, and compliance requirements

03

Launch & Scale

Go live with your token marketplace and start connecting with investors globally

Multi-Chain Support

Built for the Multi-Chain Future

Launch your marketplace on leading blockchain networks with full EVM compatibility

Ethereum

The world's leading smart contract platform

Polygon

Scalable and low-cost transactions

Avalanche

Lightning-fast finality and throughput

BNB Chain

High performance and efficiency

Full EVM Compatibility

Seamlessly deploy across all Ethereum Virtual Machine compatible chains. One codebase, unlimited possibilities.

Regulatory Ready

Built-In Compliance from Day One

Meet regulatory requirements with confidence. OpenRWA includes enterprise-grade compliance tools

T-Rex Protocol

Industry-leading security token standard with built-in transfer restrictions, identity management, and regulatory compliance. Ensure your tokens meet international securities regulations.

Identity Verification

Integrated Know Your Customer and Anti-Money Laundering checks powered by leading identity verification providers. Onboard users confidently and stay compliant.

Legally Binding

Collect legally binding electronic signatures for subscription agreements, disclosures, and regulatory documents. Blockchain-verified audit trail included.

Investor Verification

Verify accredited investor status automatically through income, net worth, and professional credential checks. Maintain detailed compliance records effortlessly.

Flexible Integration

Every Payment Method Your Users Need

From crypto wallets to traditional fiat payments—support global transactions with ease

Custodial Wallet

Managed security for your users

Enterprise-grade custodial wallet infrastructure that handles key management, security, and compliance—so your users don't have to worry about private keys.

Bank-grade security and encryption

Automated backup and recovery

Seamless onboarding experience

Non-Custodial Wallets

Self-custody for power users

Connect with popular Web3 wallets for users who prefer to maintain control of their assets. Full compatibility with leading wallet providers.

MetaMask

Trust Wallet

Coinbase

Fiat Payments

Accept credit cards, bank transfers, and local payment methods worldwide

Multi-Lingual

Reach global audiences with support for 50+ languages out of the box

Multi-Currency

Display prices and accept payments in 150+ fiat and cryptocurrencies

Payout & Buyback

Automated dividend distributions and token buyback programs for liquidity

Ready to Build Your Token Marketplace?

Join hundreds of asset owners who are already tokenizing their assets and creating new markets

List Asset for Free

Book a Demo